With the decline of traffic bonuses and rising marketing costs, establishing a competitive advantage for your brand now depends on developing personalized segment marketing strategies based on diverse member profiles and consumer needs. The NASLD segmentation model, utilized by OmniSegment CDP under beBit TECH, dynamically segments members according to their activity levels. This enables brands to perform in-depth analysis based on member engagement, providing personalized marketing messages that enhance purchasing potential.

In this article, we will explore what the NASLD model is, why brands should leverage it to optimize their segmentation strategies, and how to effectively implement the NASLD model into your brand's marketing applications.

Introduction to the NASLD Model

Overview of the NASLD Model

NASLD is a built-in segmentation system within OmniSegment CDP, the customer data platform by beBit TECH. It is an extension of the RFM (Recency, Frequency, Monetary) model. Unlike the three-dimensional evaluation of the RFM model, NASLD focuses more on helping brands identify highly active and loyal customers to improve marketing planning and resource allocation efficiency.

NASLD stands for New, Active, Sleep, Lost, and Deep customers, with each category defined as follows:

- N (New Customers): Customers who have made one purchase within three times the repeat purchase cycle

- A (Active Customers): Customers who have made two or more purchases within three times the repeat purchase cycle

-

S (Sleep Customers): Customers who have made two or more purchases between three to six times the repeat purchase cycle but have not purchased within one repeat purchase cycle

-

L (Lost Customers): Customers who have made one purchase between three to six times the repeat purchase cycle but have not purchased within one repeat purchase cycle

-

D (Deep Customers): Customers who have not made any purchases within six times the repeat purchase cycle.

By analyzing customers' purchase frequency and recency (time since last purchase), brands can quickly understand customer activity levels and distribution. This helps in segment marketing, allowing for better personalization and targeted marketing efforts.

For the calculation, we first use the purchase frequency (F) to identify members who have 'not purchased, purchased once, or purchased more than twice'. Then, we divide them sequentially based on the repeat purchase cycle (R) of 'three times the repeat purchase cycle' and 'six times the repeat purchase cycle'. For example, assuming a brand's average repeat purchase cycle is two months, the three-times and six-times repeat purchase cycles would be six months and one year, respectively:

-

N (New Customers): One purchase within six months

-

A (Active Customers): Two or more purchases within six months

-

S (Sleep Customers): Two or more purchases between six months to one year, but no purchases within the last six months

-

L (Lost Customers): One purchase between six months to one year, but no purchases within the last six months

-

D (Deep Customers): No purchases within one year

Customers with different purchase frequencies within these repeat purchase periods represent varying purchase probabilities and loyalty levels. By utilizing this segmentation, brands can more accurately tailor marketing strategies and communication content to address the needs of different customer segments.

Eliminate Data Misinterpretation with the NASLD Model to Enhance Brand Operational Performance

In the past, when analyzing a brand's monthly performance, we often encounter data misinterpretation due to a lack of understanding of member distribution. Suppose a brand had 300,000 active members last month, reflecting a nearly 10% growth from the previous month. At first glance, this might suggest excellent operational performance. However, through customer segmentation into 'new customers' and 'existing customers', coupled with comprehensive analysis using the NASLD model, we can uncover hidden risks beneath the growth figures.

Using the example above, we can observe that the brand's purchase momentum for the month primarily derived from first-time buyers and relatively inactive S, L, and D members among existing customers. Conversely, the core customer segments—New and Active members—showed a decline in performance.

For the brand, while the revenue performance of new and dormant users is impressive, the ability to sustain the purchasing power of the active customer base is equally important. Therefore, the brand needs to further analyze the reasons for the decline in active user revenue for the month—is it due to an unappealing product combination, or insufficient discounts? By clarifying the situation with each customer segment, brands can optimize marketing strategies and implement the most appropriate marketing plans to capture sales opportunities.

From the above case, it is evident that the NASLD model can help brands quickly dissect their operational performance, understand the distribution of all members, and formulate personalized marketing communication content. This enhances the motivation for member repeat purchases, creating a more stable revenue curve.

How to Implement the NASLD Model in Customer Management

After understanding the segmentation of customers, what strategies should we use to deepen customer engagement? As mentioned in the previous section, A (Active Customers) is the customer segment that has made recent active engagement with the brand, and is a major source of revenue. Therefore, when implementing NASLD in strategic planning, our core goal should be to maximize the A (Active Customers) segment. This involves driving other segments toward becoming Active Customers, thereby gradually building stronger customer relationships.

- Encourage Repeat Purchases from N (New Customers)

- Maintain Engagement of Existing A (Active Customers)

- Re-engage S (Sleep Customers), L (Lost Customers), and D (Deep Customers) to return for repeat purchases

NASLD Basic Application — Understanding Customer Segments to Build Stronger Customer Relationships through Personalized Communication

N (New Customers): After-sales Service and Related Product Recommendations to Strengthen Repeat Purchase Motivation

New customers are those who have recently interacted with the brand for the first time. Although lacking in brand awareness, they have significant potential to be moved towards becoming Active Customers. Therefore, within 7 days after their first purchase, brands can deliver after-sales messages to actively inquire about their satisfaction with the shopping experience. Through in-depth two-way communication, creating a more comprehensive customer profile. Additionally, in the next marketing message, brands can use the collected information to recommend related products of the customer's interest, thus enhancing their willingness to perform a repeat purchase.

A (Active Customers): Exclusive Discounts and Service Experiences to Sustain Active Engagement Levels

Active Customers are highly valuable due to their significant purchasing power and loyalty. To reinforce their engagement and repeat purchase rate, brands can offer exclusive discounts around their repeat purchase cycle (e.g., VIP discounts like $200 off $1,000, or bundled product offers) to create a sense of privilege. This encourages positive interaction with the customer and sustains their purchasing momentum.

S (Sleep Customers), L (Lost Customers), D (Deep Customers): Consistent Communication During Campaign Periods to Encourage Purchases

Although Sleep, Lost, and Deep customers have made purchases previously, they are the customer group with declining interaction frequency. To re-engage these inactive customers, brands should intensify their communication frequency during campaign periods in addition to their periodic communication. Offering discount vouchers and personalized product recommendations can rekindle their interest and demand for the brand, guiding them to make another purchase.

Advanced Application of NASLD—Insight into Revenue Performance by Segment and Enhanced Marketing Efficiency through Automated Customer Journeys

By segmenting customer using the NASLD model, brands can gain an initial understanding of their current operational status. This segmentation allows brands to observe the conversion rates at each stage of the sales funnel, providing insights into the revenue performance of each segment. Using these insights, brands can optimize their marketing strategies based on relevant metrics to enhance marketing effectiveness.

|

Number of Website Visitors |

Number of Add-to-Cart Customers | Number of Buyers | Revenue Performance | |

| N, A (Active Customers) |

+ 7.5% | +15% | -5.3% | -12 thousand(-2.2%) |

| S, L, D (Inactive Customers) |

-5.4% | +5% | +2% | -37 thousand(-4.5%) |

*The above is a comparison to the data in the previous month

To help you quickly understand the advanced application of NASLD, here are two practical cases:

High Website Visits and Add-to-Cart Numbers from N and A (Active Customer Segments), but Declining Checkout Rates

A detailed look at the interactions between N and A (Active Customer Segments) and the brand reveals that the number of members browsing products and adding items to their carts has significantly increased compared to the previous month. However, the final stage of the sales funnel—number of buyers—has not seen a corresponding rise. This indicates that the brand's marketing content and communication strategies effectively sparked purchase interest but failed to convert it into completed orders.

To address this issue, brands can use the built-in 'Abandoned Cart' customer journey in OmniSegment CDP. For the large number of N and A customers who have added items to their cart but have not checked out, to send abandoned cart marketing messages at intervals of 1 day, 3 days, and 7 days. Additionally, it would also be effective to deliver after-sales messages upon successful checkout. This approach does not only enhances the purchase intention and conversion rate of N and A segments, but also encourages continuous engagement through follow-up messages, fostering the cyclical management of existing traffic.

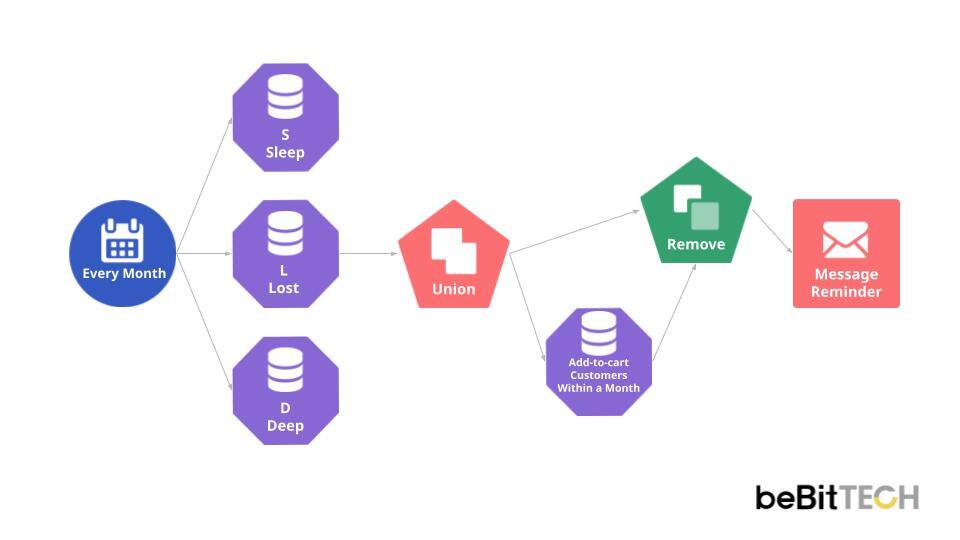

Declining Website Visits from S, L, and D (Inactive Customer Segments), but High Add-to-Cart and Checkout Rates

In contrast to the previous situation, the number of visits from S, L, and D (Inactive Customer Segments) have decreased compared to the previous month. However, both the number of add-to-cart customers and checkout rates have increased. This indicates that the brand's marketing strategies effectively re-engage dormant users and even convert them into buyers. However, the lack of front-end website traffic limits the brand's ability to engage in-depth with a larger customer base, thus limiting overall effectiveness.

To tackle this issue, brands can opt to use the 'Dormant Customer Re-engagement' customer journey in OmniSegment CDP. Sending marketing messages such as new product launches and discount coupons can help to re-engage inactive customer segments on a monthly basis. This significantly boosts their willingness to visit the site. Additionally, during promotional periods, small-scale promotions can also help to encourage members to reconnect, thereby enhancing engagement and driving purchases.

Conclusion

Through the explanations provided above, we hope that brands now have a clearer understanding of how to use the NASLD model to clarify their operational performance and communicate effectively with respective customer segments. This knowledge will also guide brands in planning effective marketing activities and allocating resources more precisely. Furthermore, as the most highly-regarded customer data platform for e-commerce and brands, OmniSegment CDP's built-in NASLD analysis module and automated marketing applications help brands create highly personalized customer experiences, strengthening interactions with customers, and maintain stable revenue growth.

If you would like to learn more about beBit TECH's customer data platform—OmniSegment CDP, please feel free to click on the 'Contact Us' button on the right, and we will get in touch with you soon!

beBit TECH is Asia's leading consulting technology company. As the iconic subsidiary of Japan's prestigious DX consulting company beBit Group, beBit TECH integrates an in-depth understanding of customer experience and cutting-edge yet user-centered technology.

With profound digital business strategies, the no-code designed AI customer data platform (CDP) and effective customer success insights, beBit TECH provides an all-in-one solution that includes consulting service, SaaS, and data analytics for DX and CX.

beBit TECH's vision is to create a Trillion Smile society.

Boost brand value and achieve sustainable growth with beBit TECH's AI-powered SaaS products, data consulting, and business strategy services.

TAGS

Boost brand value and achieve sustainable growth with beBit TECH's AI-powered SaaS products, data consulting, and business strategy services.