In our previous article, we explored How E-commerce Businesses Can Leverage the RFM (Recency, Frequency, Monetary) Model to Identify and Target High-value Customers. The RFM model categorizes customers into eight distinct groups based on their value, serving as a reference for subsequent strategy and resource allocation. Additionally, RFM analysis can be used to enhance customer loyalty, increase average order value, and boost per capita contribution. In this article, we will focus on how to interpret RFM reports to help brands better execute their customer relationship management strategies.

In addition, we will also share on ways to leverage the customer journey template provided by beBit TECH's customer data platform—OmniSegment CDP—to quickly organize massive amounts of order and member data, generate RFM analysis reports, and assist marketing teams in collecting, integrating, and analyzing data rapidly without requiring much resources. Let's dive in!

How do we Interpret RFM Data?

In terms of interpreting RFM data, we will analyze the data separately from the three main dimensions of the RFM Model: Recency, Frequency, and Monetary, using illustrative report charts (all report data is independent of each other). All data can be retrieved through OmniSegment CDP, and the retrieval method will be shared at the end of the article.

Common Fields in RFM Reports:

- Number of People: The number of members in that segment

- Cumulative Total Number of People: The cumulative number of people from the bottom up, for example, the total number of people who have made a purchase more than once

- Revenue Contribution: The revenue contributed by that segment to the brand within a year

- Revenue Contribution Ratio: The proportion of total brand revenue contributed by that segment

- Number of Transactions: The number of transactions generated by that segment within a year

- Average Order Value: The average amount of each order

- Per Capita Contribution: The revenue each member in that segment can bring to the brand within a year

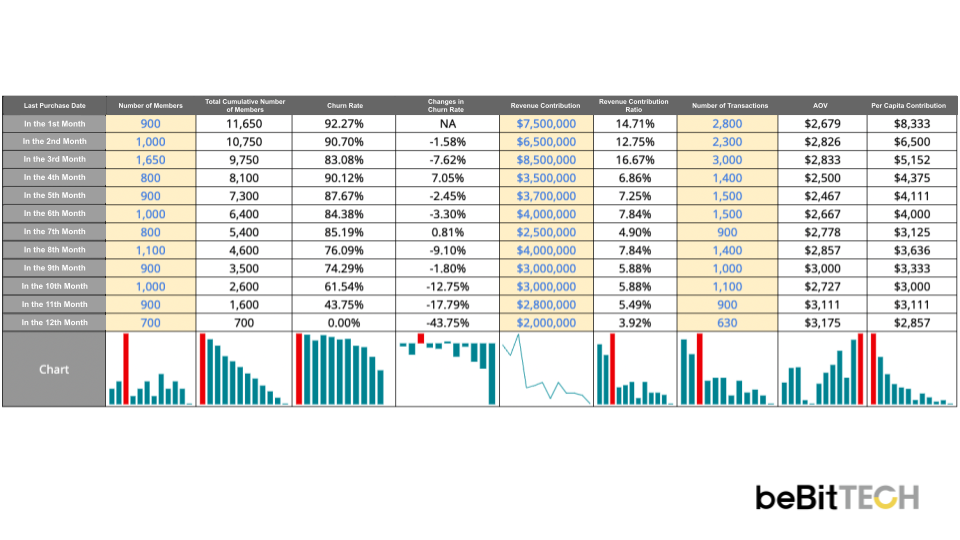

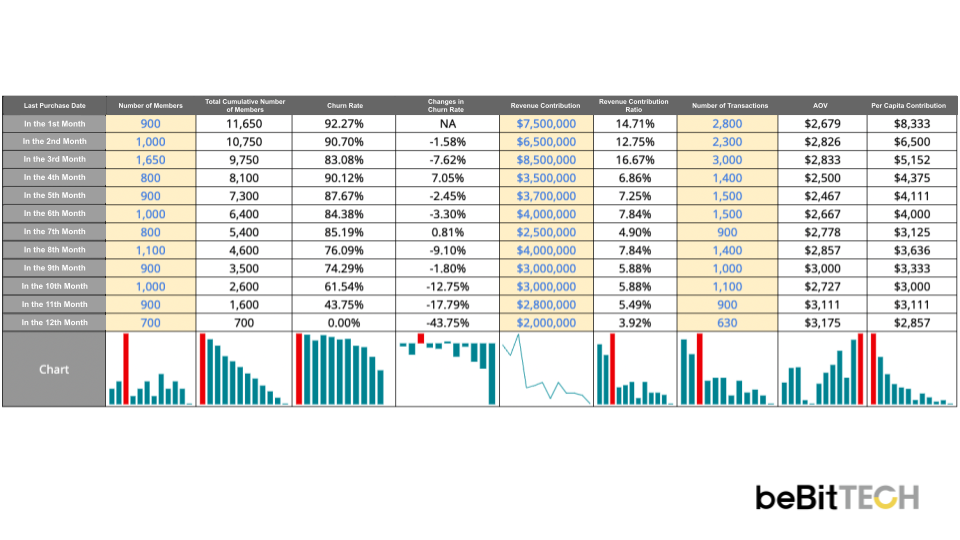

Recency: Enhancing Member Engagement Levels Through Data on Churn Rate

- Through understanding the relationship between 'Last Purchase Date' and 'Per Capita Contribution', it can be observed that the longer the time since the last purchase date, the lesser the contribution of the customer to the brand.

- Churn Rate Formula = 1 - (Number of People in the Segment/Cumulative Total Number of People).

- The ratio of (Number of People / Cumulative Total Number of People) represents the proportion of customers remaining at that stage. For example, if out of all customers who made a purchase before the second month (1,000 out of 10,750 (9.3%) made a purchase in the second month), it implies that 90.7% made their last purchase more than three months ago, indicating a 90.7% churn rate.

- If the change in churn rate is greater than 0, it indicates an increase in the churn proportion. This segment should be focused on for communication and engagement efforts to reduce churn.

- The data shows that the churn rate increased in the fourth month since the last purchase. Therefore, it is recommended to deliver repeat purchase reminders to these members between the third and fourth month after their last purchase. This helps maintain member loyalty and encourages continuous repeat purchasing, preventing further churn.

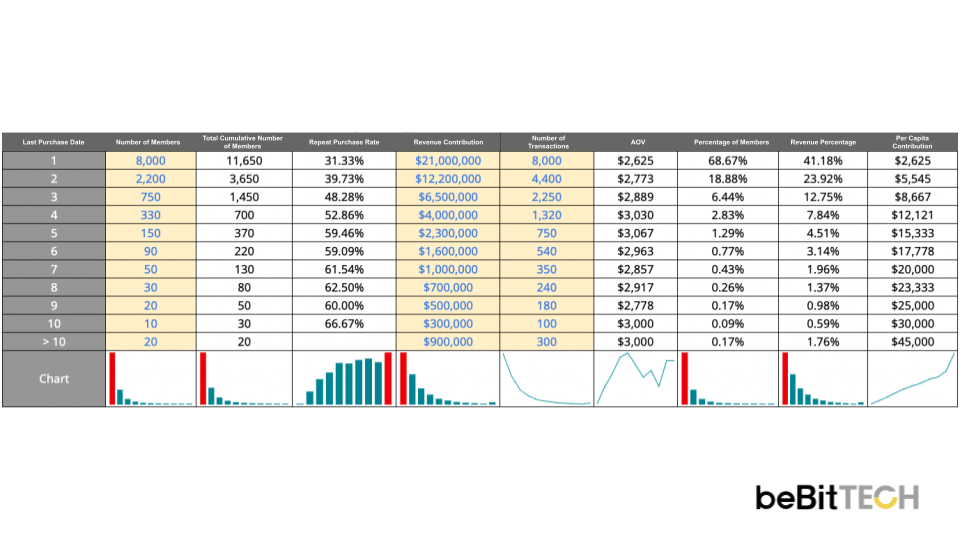

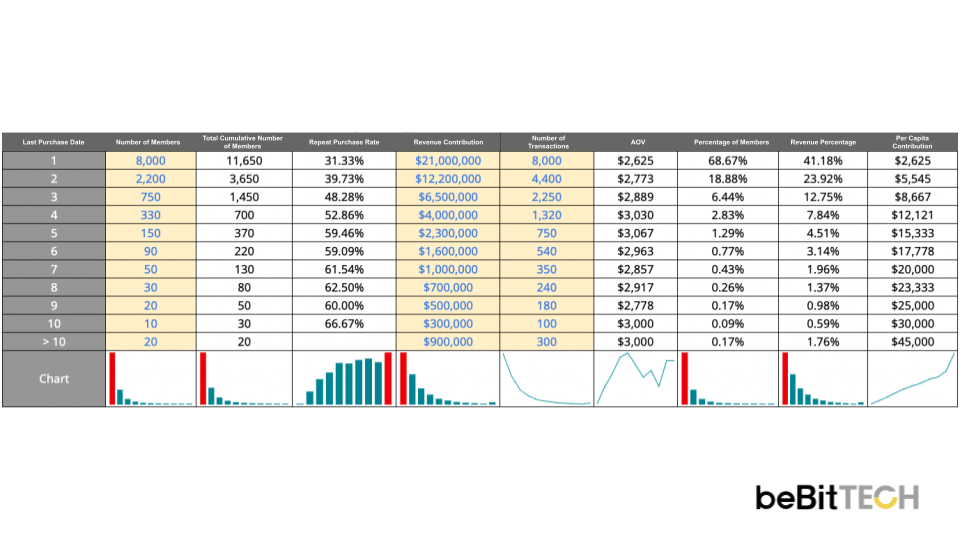

Frequency: Leveraging Purchase Frequency Data to Enhance Customer Value

-

As the number of purchases increases, the number of customers in each segment tends to decrease, but their per capita contribution rises. This indicates that customers who make more frequent purchases, though fewer in number, generate significantly higher revenue for the brand.

-

For instance, customers with more than 10 purchases might be only 20 in number, but their average contribution is an impressive 45,000 dollars. In comparison, customers who purchase once a year contribute 2,625 dollars. This shows that the value of loyal customers is 17 times higher, underscoring the importance of maintaining and nurturing these high-value members.

- Repeat Purchase Rate = (Number of people who have purchased more than N+1 times / Number of people who have purchased more than N times).

-

For example, among customers who have made a purchase once, this metric represents the proportion of those who will make another purchase. The data shows that customers who have made at least one purchase have a 31.33% chance of making a subsequent purchase.

-

The data indicates that encouraging members to make at least three purchases leads to a more stable repeat purchase rate. Therefore, aiming to get members to complete three purchases can be a strategic goal for brands.

-

Customers who have made three purchases have a repeat purchase rate of 48.28%. This means that if members can be encouraged to complete three purchases, there is more than a 50% chance for them to continue purchasing throughout the year, achieving a stable repeat purchase pattern.

-

It is also important to consider the marginal effect of the repeat purchase rate. For example, guiding a member from making 1 purchase to 2 purchases increases the repeat purchase rate by 8.44% (39.73% - 31.33% = 8.44%). Guiding a member from 2 purchases to 3 purchases increases the rate by 8.55% (48.28% - 39.73% = 8.55%). However, moving a member from 3 purchases to 4 purchases only increases the repeat purchase rate by 4%, and this rate continues to diminish. Therefore, encouraging members to make 3 purchases does not only help achieve a stable repeat purchase pattern, but also represents the optimal point when considering marginal benefits.

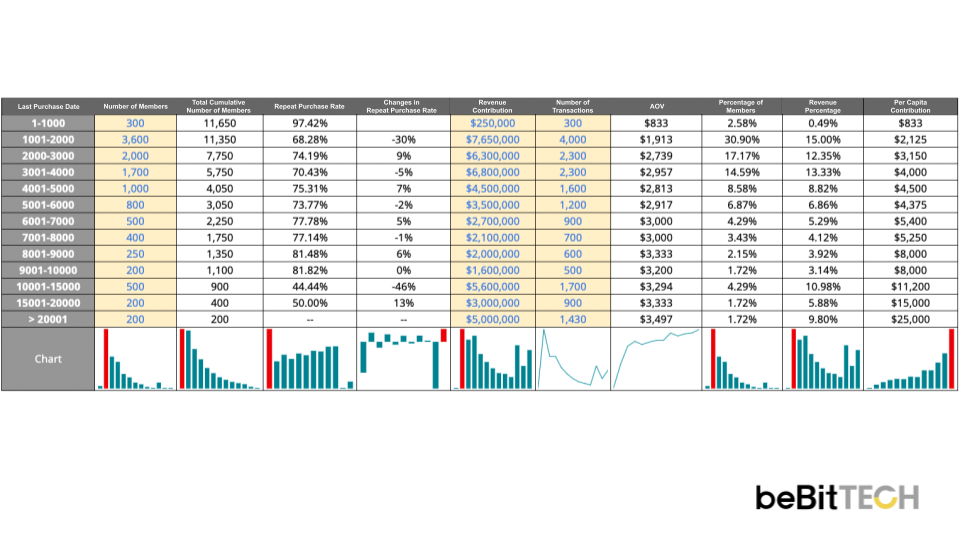

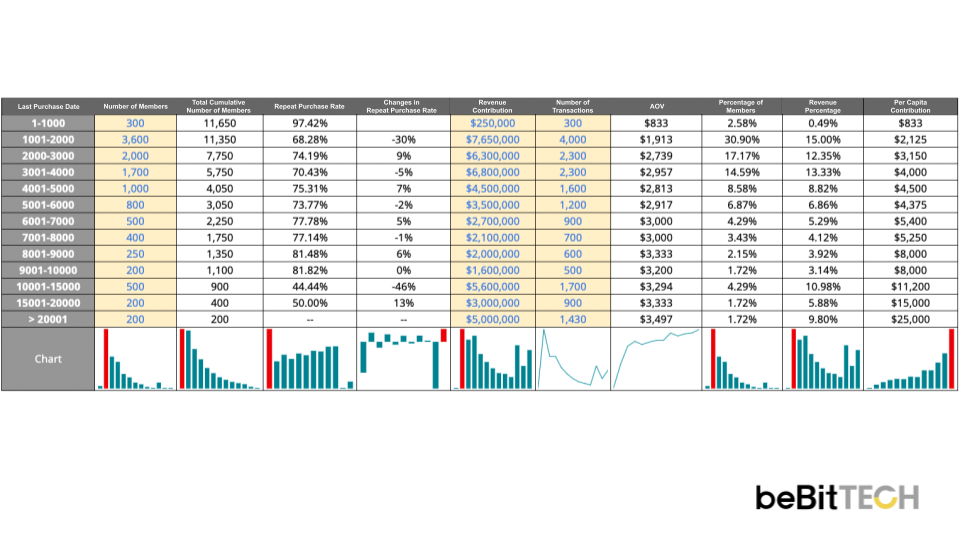

Monetary: Observing 'Repeat Purchase Rate' to Identify Key Points to Increase Customer Spending

- It is evident that members with higher spending contribute a greater per capita amount to the brand.

-

Repeat Purchase Rate = (Number of People Spending N + 1,000 dollars or More / Number of People Spending N dollars or More).

-

For example, among customers who spend between 1 and 1,000 dollars, this metric represents the proportion of those who will spend more than 1,001 dollars. The data shows that 97.42% of customers who spend at least 1 dollar will go on to spend more than 1,001 dollars.

-

It can be observed that the repeat purchase rate drops sharply in the 1,001-2,000 dollars range (repeat purchase rate change is less than 0 in the 1,001-2,000 range), but then improves afterwards. Additionally, the proportion of customers in this segment is the highest, indicating that most members are stuck in the 1,001-2,000 dollars spending range. Therefore, 2,000 dollars could be considered a threshold for establishing a membership tier. By offering benefits such as an upgrade or a gift for spending over 2,000 dollars, brands can encourage members to increase their spending.

3 Steps to Extract RFM Data in OmniSegment CDP

After understanding the key points of interpreting RFM data, brands with complete data on hand can start analyzing immediately! OmniSegment CDP, a customer data platform under beBit TECH, does not only help marketers integrate multiple data sources and automate marketing efforts, but also incorporates the RFM model as a basis to assist teams in integrating basic RFM analysis data. Extracting RFM data is a quick and simple process that only takes three steps. Let's take a look!

Step 1: Download and Activate the Customer Journey from the Customer Journey Template

Marketing teams can go to the 'Customer Journey Template' in OmniSegment CDP, download and activate the 'RFM Model Customer Journey'. The system will automatically tag customers based on different segments of spending amount, purchase frequency, and purchase recency.

Step 2: Export Tag Reports to Obtain Data

After tagging is complete, the team can use OmniSegment's tag reports to export data for the entire past year. This data includes the number of members, revenue, and transaction amounts for different segments.

Step 3: Record Data in Excel

With data on the number of members, revenue, and transaction frequency for each segment, how can you proceed with further analysis? beBit TECH provides an Excel template specifically designed to record RFM data (as shown in the illustration above). Simply fill in the yellow-highlighted, blue-text fields with data on segment numbers, revenue, and transaction counts to complete all the data needed for an RFM analysis!

🔎 Simply fill out the form on our Contact Us page and mention 'Request RFM Template' to receive a complete RFM data recording template. This will assist your team in subsequent data recording and analysis!

Conclusion

With the above guide and explanation, you should now have a basic understanding of how to interpret RFM data. Don't forget to start performing RFM analysis for your brand to understand your members' spending behaviors!

Implementing OmniSegment CDP does not only help integrate diverse data sources for your brand, but also allows for the quick consolidation of relevant data based on different analytical models, such as the RFM model shared in this article. This makes it easier for brands to interpret data, gather insights, and discuss brand strategy adjustments with the beBit TECH consulting team. Download the customer journey template from OmniSegment CDP and give it a try!

In our next article, we will share in-depth insights on how to plan membership systems based on RFM data. Stay tuned!